Qualitative Analysis

1. Do I understand the business?

Yes, Netflix is a streaming video on demand service that uses a subscription model, but is incorporating ads. We will discuss ads more at the end.

2. Will the company be around in 5-10 years?

5 years is an easy yes. 10 or 20 years things get a bit murky. I could see them getting into financial trouble as competition increases. But Netflix wouldn’t go to zero. Because of their valuable assets: 230 million subscriber, tens of billions of content assets, and customer data. Either a competitor would buy them (AAPL, AMZN) or someone looking to enter the space (MSFT). So will they be around in 5-10 years? A qualified yes.

3. Does the firm have any competitive advantages?

Let’s go down the list:

High switching costs? Are customers locked in?

No. Customer can switch back and forth between any number of competitors without much effort or cost.

Network effects? Do additional users make the product better?

I’d argue Netflix actually has a negative network effect because the more people you know who have Netflix, the more likely it is that someone will share their password with you. (We will get to their crack down on password sharing later.) But they do have scale, which leads me to…

Cost leadership? Does business have lower costs than competitors?

Yes, Netflix has a scale advantage that allows them subsidize the cost of content over a larger base of subscribers than their competitors. The problem is, I don’t think their competitors necessarily care. Apple and Amazon have their own streaming services because it peacocks the brand, adds stickiness to the eco-system, and gets the CEOs invited to the Academy Awards. While companies like Disney have alternative channels to monetize their streaming content. So yes, Netflix has a cost leadership advantage, but I just don’t think it’s important given the nature of some of their competitors.

Intangible Assets? i.e. Brand, patents, regional monopolies, etc.?

Yes, Netflix has data analytics on customer viewing habits. Who is watching what, when, how, where. I cannot say how durable this advantage is or even how large it is, but I do feel it’s worth mentioning.

Overall, I would say that Netflix has some weak competitive advantages, but is still susceptible to competition.

Quantitative Analysis

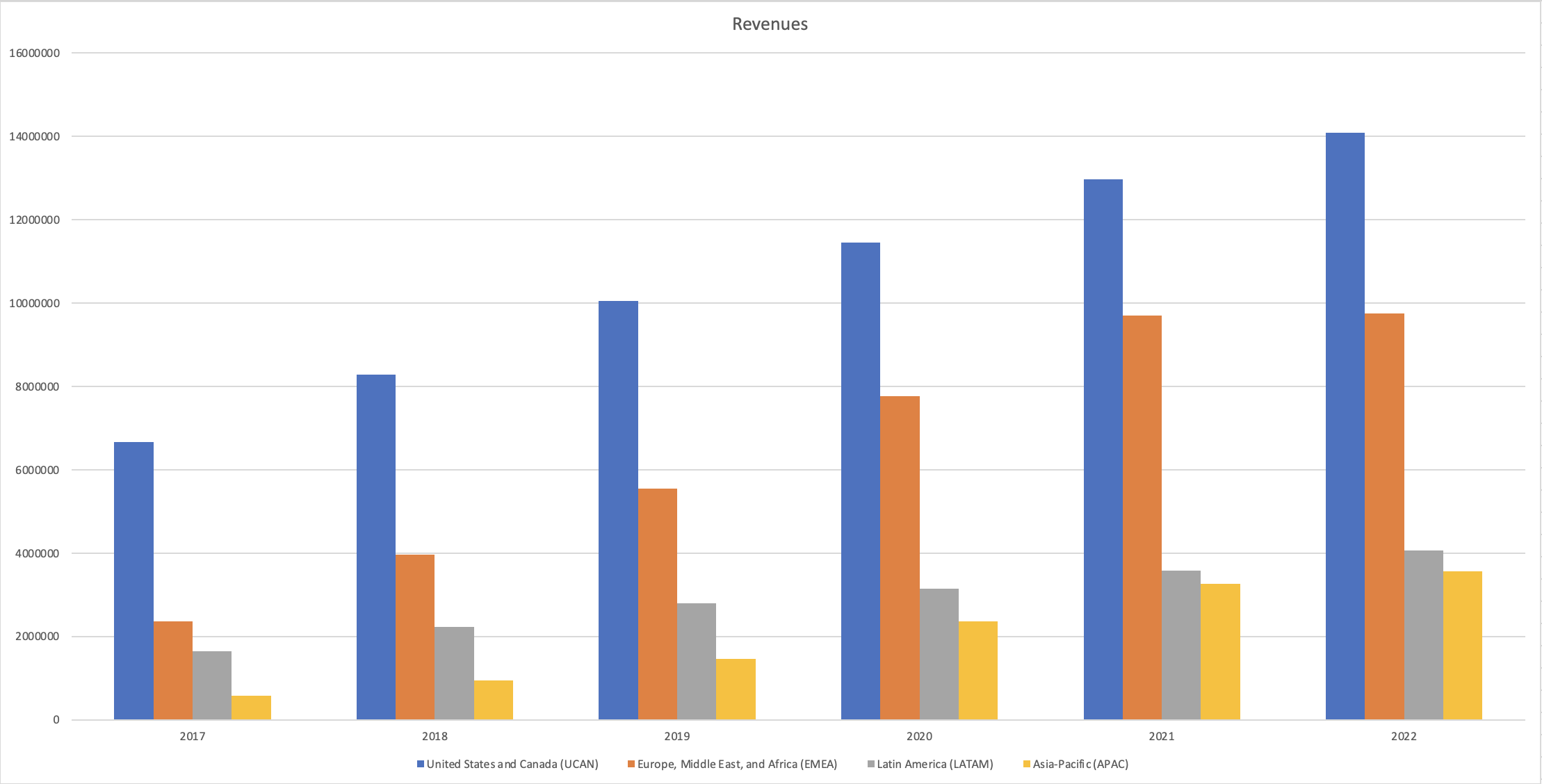

Revenues

Revenues were up 7% y/y in the face of foreign currency headwinds, inflation, increased competition, and the loss of 700,000 Russian subscribers. So why did the stock tank? It’s important to understand the key drivers behind revenue. In this case, it’s the average paying memberships and the monthly revenue per paying membership.

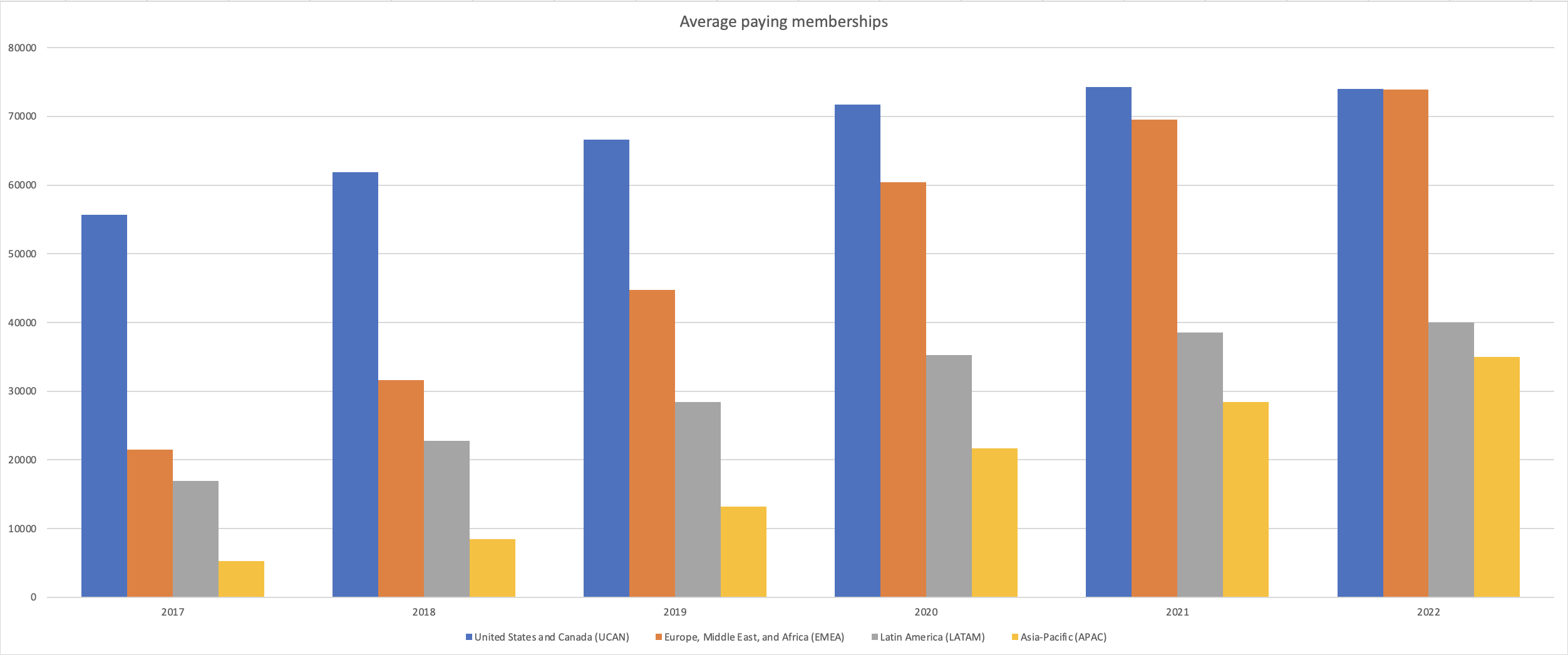

Average Paying Memberships

Average paying memberships were flat in the United States. (The blue column is ~90% the United States and ~10% Canada.) This was common across tech last year. In 2020, Covid pulled a lot of growth forward as people stayed indoors. Then in 2021 and especially 2022, things opened back up and those tech companies gave a lot of that growth back. Wall Street punished them dearly for it.

But look at the international growth. Europe (and Africa and the Middle East) has more than tripled since 2017 and has caught up with the United States. Latin America has more than doubled. Asia has more than quintupled. (The chart started at 2017 because that is when NFLX started breaking out the three international markets.)

Note: Netflix is not in China, Russia, Iran, or Crimea.

Average Monthly Revenue per Paying Membership

In the United States, Netflix has managed to increase prices from $10 to $16 in 5 years — while still managing to grow customers. Internationally, revenue per member is flat or declining which is typical at this stage of international growth. When you first break into foreign markets, you will gravitate towards developed economies like Germany or Japan. Then as time goes on, most of your new members will come from countries with lower GDP per capita. The result is that the worldwide average monthly revenue per paying membership may actually start to decline even if the average monthly revenue per paying membership is increasing across all geographies.

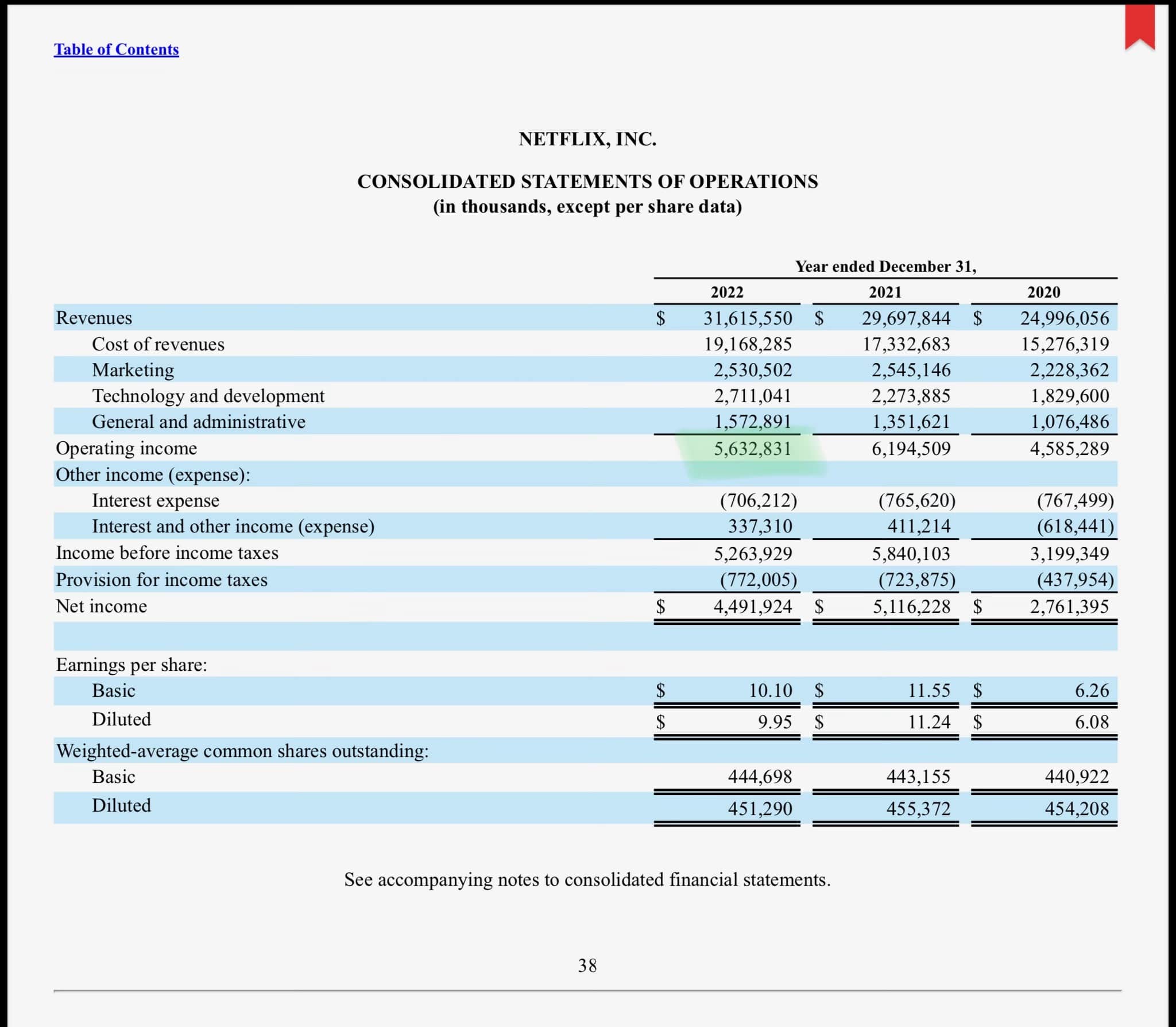

Income Statement

After determining the key drivers of revenue, we want to look at the key driver of cost. The most relevant line item here is Cost of Revenues at $19 billion. What is making up the bulk of that cost of revenue? We will find out on the Cash Flow Statement.

Another piece of relevant data I’m pulling from the Income Statement is that their Operating Income is about $6 billion.

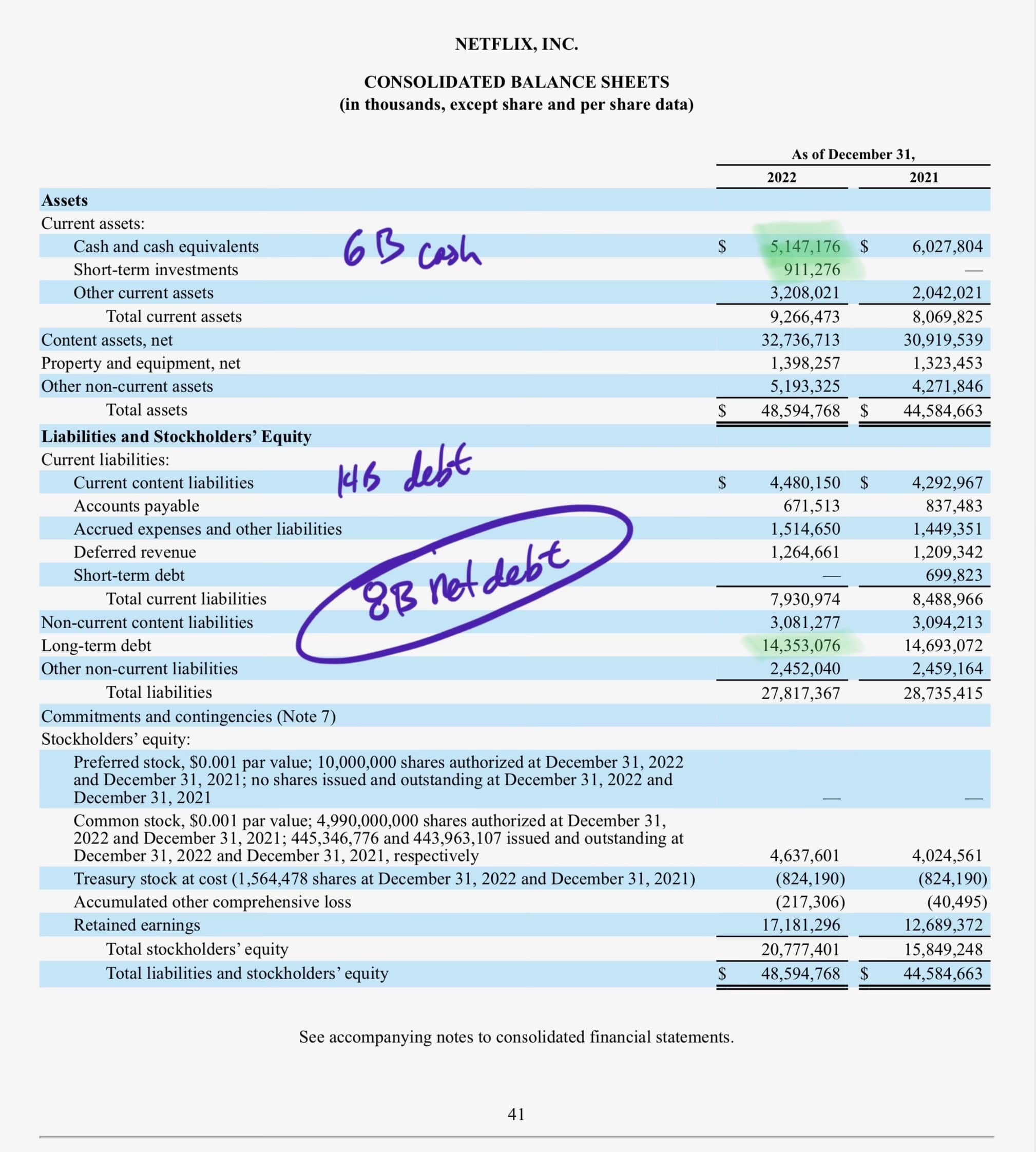

Balance Sheet

With $6 billion in cash and $14 billion debt, Netflix has a net debt position of $8 billion. I could not find any off-balance sheet items that would alter those numbers.

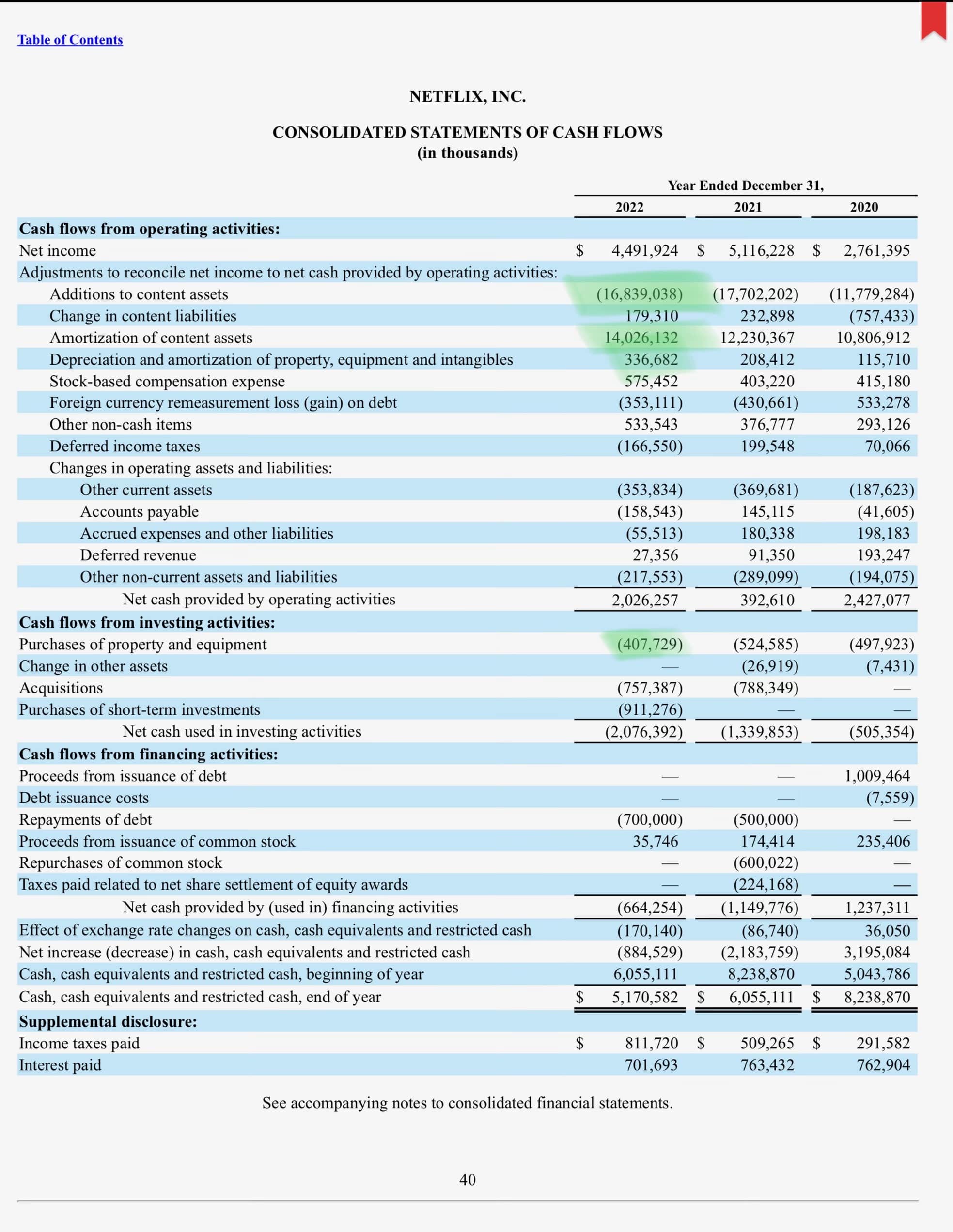

Cash Flow Statement

Netflix has Capital Expenditures (CapEx) of over $17 billion and the vast majority of that is Additions to Content Assets. $14 billion of Amortization of Content Assets shows up on the Income Statement as Cost of Revenue.

The key driver of costs for Netflix is producing and licensing content. Now that we understand the key drivers of revenue and costs, we can begin to paint a picture of where the company is headed.

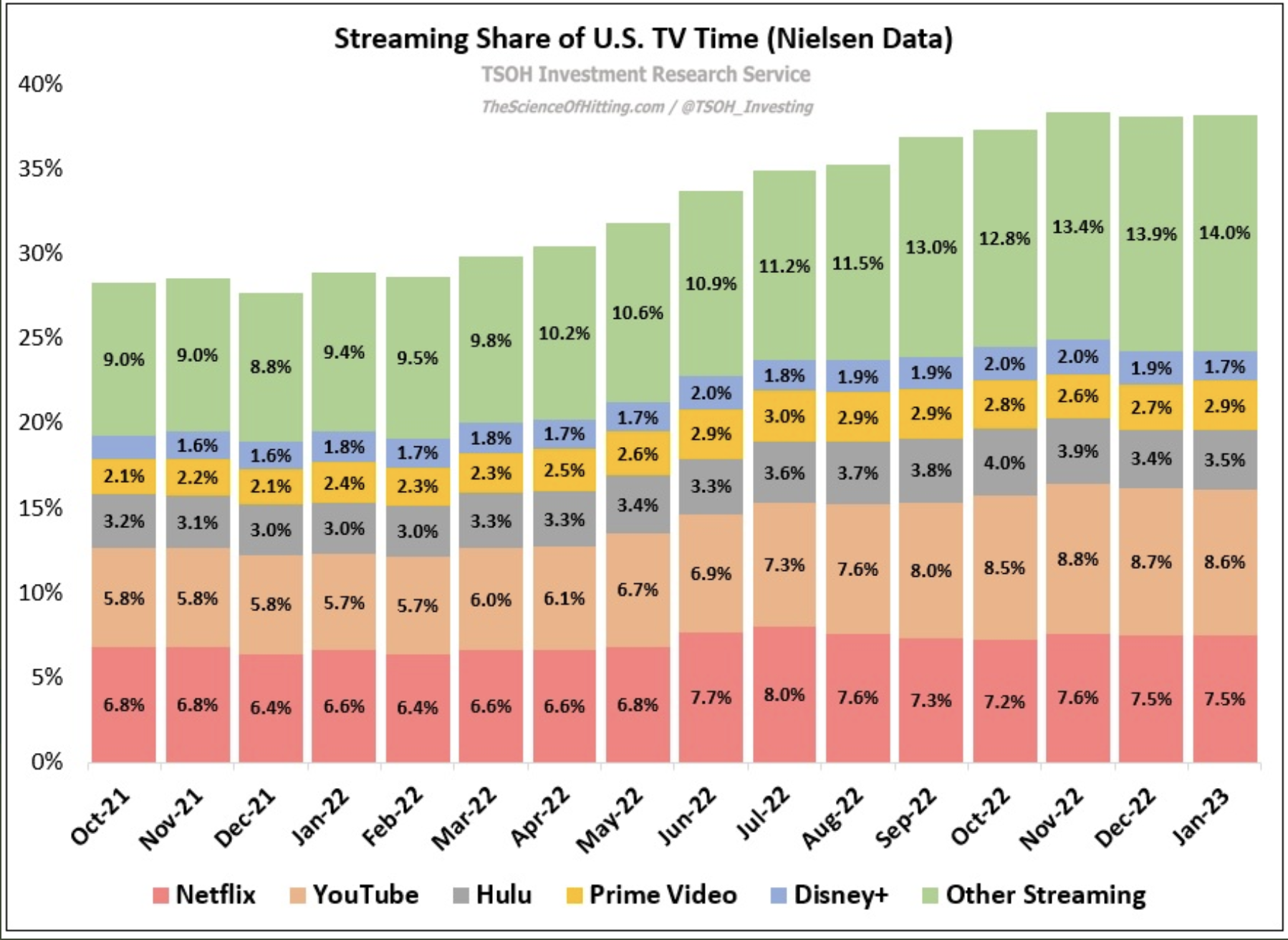

Netflix’s Share of US TV Viewing

In the United States, streaming only makes up ~40% of television watching. And Netflix only makes less than 8%. I bet that if you’re under the age of 25, it’s probably 80/20 streaming to linear. While if you’re 65, it’s probably 80/20 in the other direction. Point being, there is still a lot of room to grow in the streaming industry.

Note: This presentation has been US-centric and that is because the US is the most developed market Netflix has. So if you’re trying to predict where the other geographies are headed, then the US is a decent yardstick.

Why Crack Down on Password Sharing?

To increase Average Paying Memberships.

- I estimate that there are only 67 million Netflix subscribers in the United States.

- That is out of 120 million US households with broadband internet.

- Hence, a penetration rate of about 56%.

- Compare that to when cable was at its peak in 2013.

- Cable was in 100 million out of 123 total households. Or about 81%.

- I’m speculating that Netflix believes it can hit that that 81% number that cable enjoyed, but to do that, they want to unlock non-paying users.

Why Introduce Ads?

To increase Average Monthly Revenue per Paying Membership.

- The average American watches three hours of TV per day

- An average of hour of TV contains about 20 minutes of ads

- Hence, the average American watches about 1 hour of commercials per day

- Advertisers spend about 3 cents per viewer for each 30 second ad

- Hence, advertisers spend $3.60 per viewer per hour

- $3.60 times 30 days equals $108 a month

$108 is a lot more than Netflix gets from a subscription.

How much does Netflix cost?

Using Value Line’s January 27th estimate of Netflix’s 2023 financials, Netflix has an Enterprise Value to Future EBIT ratio of about 19.

Do you think that Netflix will survive the competition?

Yes, I think Netflix and a few other premium services like HBO and Disney are favorites to survive the inevitable consolidation of the streaming industry.

Will some competitors, perhaps Comcast (CMCSA) or Paramount (PARA), shut down their unprofitable streaming services and return to lucrative licensing deals with Netflix? Thus decreasing competition and lowering content costs for Netflix?

Yes, I believe the streaming industry will consolidate. Shareholders will grow impatient of losses from streaming services and urge their CEOs to return to licensing their content.

Will Netflix successfully crack down on password sharing? Will it lead to an increase in paying memberships?

I think this is probably a mistake. Destroying value while faced with increased competition is probably not a great idea. The company feels like they have to make this move because Wallstreet hammered the stock for flat user growth in the US. The truth is, most tech stocks got hammered. Companies shouldn’t alter or accelerate their plans because of Wallstreet.

Will Netflix successfully introduce ads? Will it lead to an increase in revenue per membership?

Again, I think this is probably a mistake — though I admit I’m less militant than I have been in the past.. So much of Netflix’s value is in not having commercials. I think if you add commercials, users will watch TV elsewhere. Though I can appreciate the strategy of cracking down on password sharing while offering a cheaper alternative.

Will Netflix figure out how to lower their production costs, thus lowering their Cost of Revenue and increasing margins?

I don’t believe so. To withstand the fierce competition, they will have to increase production.

Are you a Bullish or Bearish?

I’ve always been bearish on Netflix’s stock. Even when it fell back down to under $80 billion last year (2022), I resisted the urge to buy — and double my money. Because the world doesn’t need Netflix. There is nothing that they do that any number of other companies can’t do. Though I do admit that every that goes by is another year that no one does what Netflix does. And that is offer an insane variety of quality content at an affordable price. All with an intuitive and user friendly interface. Other streaming services either have limited content, ie Disney or HBO, or have confusing interfaces that mix free and paid content, ie Apple or Amazon. But neither of those two advantages are especially durable… despite how long they have endured.

Daniel Hansen owns AAPL, AMZN, DIS, & MSFT